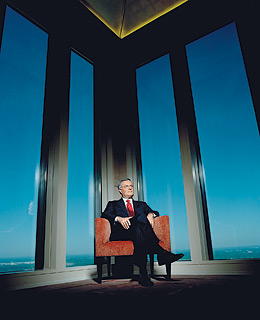

Ken Lewis

As a sports-loving kid, Ken Lewis figured he would grow up to become a great athlete. When a back injury ended that dream, he told an interviewer, he applied his determination instead to business. Raised in modest circumstances—he grew up in Georgia as the son of a nurse and an Army sergeant—Lewis went door-to-door peddling Grit, a weekly newspaper, and later got a job selling shoes. He proved to have an extraordinary talent for making money.

These days, as CEO of Bank of America, Lewis presides over an institution that holds more Americans' money than any other bank. The firm's red logo appears on some 17,000 ATMs. The Bank of America, based in Charlotte, N.C., is second to Citigroup in total assets but is the largest consumer bank in the U.S., holding $591 billion in deposits and serving some 55 million households—a result of acquisitions by Lewis and his predecessor, Hugh McColl. The retail powerhouse brought in $21.1 billion in profits last year.

Lewis, 60, has also muscled his way into mortgages, wealth management and credit cards, most recently acquiring card giant MBNA for $34.2 billion. While Citigroup laid off 17,000 workers this spring, Lewis basked in his firm's 28% earnings surge—and his own $21 million pay package.

Lewis provoked controversy this year when he tried to expand services to the millions of "unbanked" Americans. His plan for a credit card that would not require holders to provide a Social Security number won plaudits for innovation but got panned by foes of illegal immigration. (Some critics called for a boycott of the bank and mailed their cut-up cards to Lewis.) But nobody said running "America's bank" would be easy.